Objective

Activities

Objective

Activities

Objective

Activities

1. Introduction to the organization's mission, values, and financial literacy objectives.

2. Workshops on effective financial education strategies, curriculum development, and community outreach.

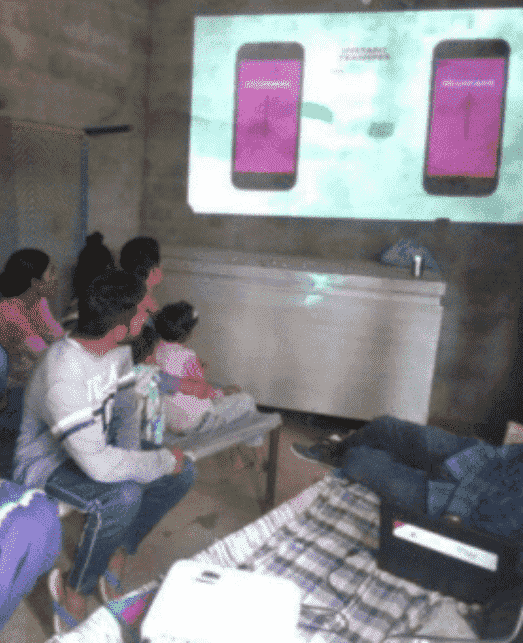

1. Participate in offline financial literacy workshops targeting specific topics.

2. Utilize online platforms for virtual financial education sessions and webinars.

1. Conduct community outreach to promote financial literacy awareness.

2. Collaborate with local leaders and organizations to engage with target communities.

1. Contribute to the development of financial literacy curricula.

2. Engage in research on financial trends, resources, and best practices.

1. Utilize online platforms for virtual learning sessions and e-learning modules.

2. Engage in discussions and collaborative projects with a global network of financial educators.

1. Regular feedback sessions to evaluate the effectiveness of financial literacy initiatives.

2. Encourage interns to propose improvements and innovative ideas.

1. Provide one-on-one or group financial counseling sessions for community members.

2. Collaborate with local financial institutions for additional support.

1. Interns will document their experiences, successes, and challenges in a comprehensive report.

2. Present findings and recommendations for future financial literacy initiatives.

Registration, Mapping and Project Planning 3000/- per project

Project management online 3500 Monthly

Project management offline 5000 monthly

The "Empowering Minds, Transforming Lives" internship program offers interns a flexible and enriching experience in mental health support. By providing short-term, mid-term, and long-term internship options, this program accommodates diverse learning objectives and time commitments, contributing to the development of compassionate mental health support volunteer/Interns.